Insurance: Safeguarding Your Future

Insurance: Safeguarding Your Future

Introduction to Insurance

Insurance is a risk management tool that provides financial protection against potential losses or unforeseen events. It is an agreement between an individual or entity (policyholder) and an insurance company, where the policyholder pays regular premiums, and in return, the insurer promises to compensate for covered losses.

How Insurance Works

1. Identification of Risks

Insurance begins with identifying potential risks faced by individuals or businesses. These risks can include property damage, accidents, illness, disability, liability, and more.

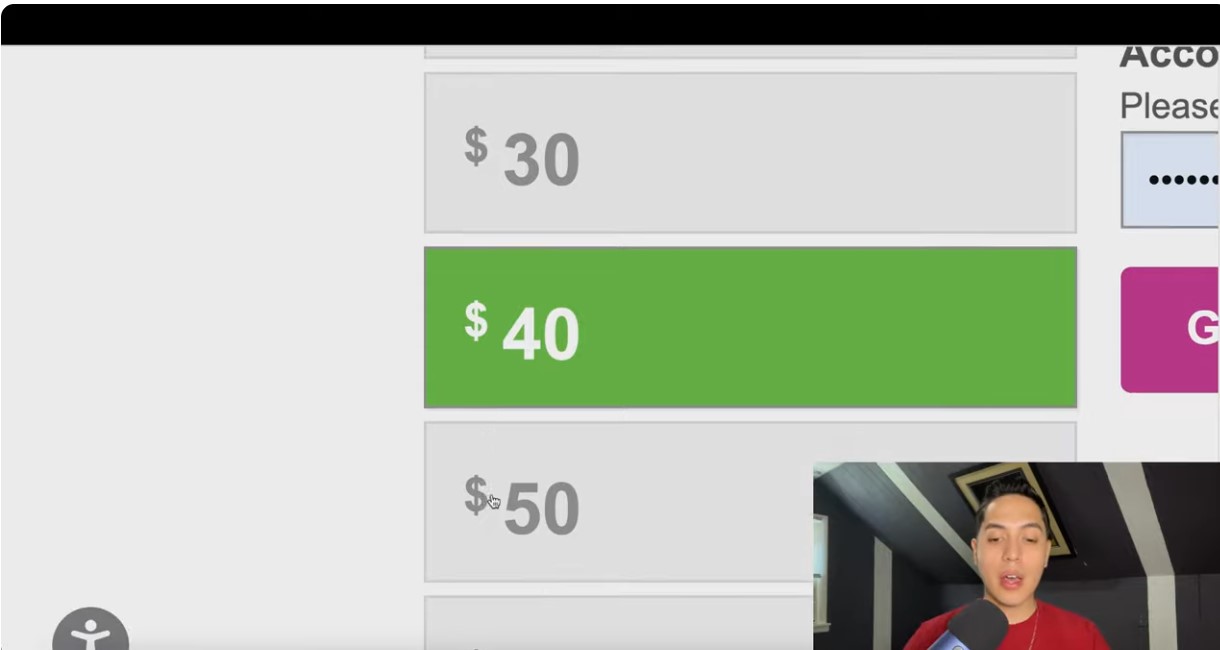

2. Premium Payments

Policyholders pay premiums, typically monthly or annually, to the insurance company. Premiums vary based on the level of coverage, type of insurance, and risk profile of the policyholder.

3. Risk Pooling

Insurance companies pool the premiums collected from policyholders to create a fund that can be used to pay claims when covered losses occur.

4. Claim Settlement

When a policyholder experiences a covered loss or event, they file a claim with the insurance company. The insurer evaluates the claim's validity and compensates the policyholder based on the terms and conditions of the policy.

5. Loss Prevention and Risk Mitigation

Insurance companies often offer resources and guidance to policyholders on how to prevent losses or minimize risks. This proactive approach benefits both the policyholder and the insurer.

Types of Insurance

1. Life Insurance

Life insurance provides financial protection to the policyholder's beneficiaries in the event of the policyholder's death. It can help cover funeral expenses, outstanding debts, and provide financial support to dependents.

2. Health Insurance

Health insurance covers medical expenses, including doctor visits, hospitalization, prescription drugs, and preventive care. It ensures that policyholders have access to healthcare services without incurring substantial out-of-pocket costs.

3. Auto Insurance

Auto insurance offers protection against financial loss due to car accidents, theft, or damage. It can cover vehicle repairs, medical expenses, and liability for injuries or property damage to others.

4. Home Insurance

Home insurance protects homeowners from financial losses related to their property. It covers damage to the house and its contents due to fire, theft, vandalism, and other covered perils.

5. Business Insurance

Business insurance provides coverage for various risks faced by businesses, including property damage, liability claims, business interruption, and employee injuries.

Benefits of Insurance

1. Financial Security

Insurance provides a safety net, ensuring that policyholders are financially protected from unexpected events. It offers peace of mind, knowing that potential losses are covered.

2. Risk Transfer

Insurance allows individuals and businesses to transfer the financial burden of certain risks to the insurance company. This helps protect their assets and financial well-being.

3. Promotes Investment and Borrowing

Insurance coverage can make individuals and businesses more attractive to lenders and investors, as it demonstrates a level of financial stability and risk management.

4. Community and Economic Stability

Insurance contributes to the overall stability of communities and economies by mitigating the financial impact of disasters and accidents.

Conclusion

Insurance is a crucial aspect of financial planning and risk management. It offers a safety net, protecting individuals and businesses from unforeseen events that could otherwise have devastating financial consequences. By providing financial security and promoting stability, insurance plays a vital role in safeguarding our future.

Get Access Now: https://bit.ly/J_Umma

FAQs

Is insurance necessary if I have a good emergency fund?

- While having an emergency fund is important, insurance provides additional protection against significant financial losses that may exceed the fund's coverage.

What factors determine the cost of insurance premiums?

- Insurance premiums are influenced by factors such as the level of coverage, the type of insurance, the policyholder's risk profile, age, health, location, and claims history.

Can I change my insurance coverage or provider after purchasing a policy?

- Yes, you can typically make changes to your insurance coverage or switch to a different provider during the policy term or at the time of renewal.

Are there insurance policies specifically designed for businesses?

- Yes, business insurance offers a range of coverage options tailored to meet the specific needs and risks faced by different types of businesses.

How can I lower my insurance premiums?

- You can lower your insurance premiums by bundling multiple policies with the same insurer, maintaining a good credit score, implementing safety measures, and avoiding unnecessary risks.

تعليقات

إرسال تعليق